The Malaysian semiconductor industry is experiencing an unprecedented wave of expansion as global chip packaging and testing giants pour billions into production capacity. Against the backdrop of worldwide semiconductor shortages and geopolitical tensions, this Southeast Asian nation has emerged as a critical hub for ensuring the stability of global electronics supply chains.

For decades, Malaysia has quietly built its reputation as a reliable manufacturing base for semiconductor companies. What began with Intel establishing its first offshore assembly plant in Penang in 1972 has evolved into a sophisticated ecosystem of packaging and testing facilities that now account for approximately 13% of global semiconductor trade. The current expansion frenzy represents the largest concentrated investment the country has seen in this sector since the 1990s.

Multiple industry leaders are simultaneously executing ambitious expansion plans across different Malaysian states. Intel recently announced a $7 billion investment to expand its advanced packaging capabilities in Penang and Kulim, creating over 4,000 construction jobs and more than 1,000 permanent technical positions. The company's Malaysia operations have become its largest advanced packaging facility worldwide, underscoring the strategic importance of this Southeast Asian location.

Meanwhile, Infineon Technologies is pouring another €2 billion into expanding its power semiconductor frontend and backend operations in Kulim High-Tech Park. This represents the single largest investment in Infineon's history and will significantly boost production of chips essential for electric vehicles, renewable energy systems, and data centers. The German chipmaker has operated in Malaysia since 1973 and considers the country a cornerstone of its global manufacturing strategy.

Texas Instruments is not standing idle either. The American semiconductor giant is constructing additional assembly and test facilities in Melaka and Kuala Lumpur, representing its most significant capacity expansion in Malaysia to date. These facilities will focus on analog chips used across countless electronic devices, from smartphones to industrial equipment.

The driving forces behind this investment surge are multifaceted and reflect broader industry trends. The global chip shortage that began during the pandemic exposed vulnerabilities in concentrated supply chains, prompting companies to diversify their manufacturing footprints. Malaysia's established infrastructure, skilled workforce, and political stability make it an attractive alternative to traditional manufacturing hubs.

Geopolitical tensions between the United States and China have accelerated this diversification trend. Many semiconductor companies are adopting a "China Plus One" strategy, maintaining operations in China while establishing additional capacity elsewhere. Malaysia's neutral political stance and robust trade relationships with both economic superpowers position it perfectly to benefit from this rebalancing.

Technological evolution is another critical factor. The semiconductor industry is transitioning toward advanced packaging technologies like 2.5D and 3D packaging, which allow multiple chips to be integrated into single packages for better performance and energy efficiency. Malaysia's decades of experience in traditional packaging provide a solid foundation for mastering these more complex techniques.

Malaysia's government has actively cultivated this investment environment through strategic policies and infrastructure development. The National Investment Aspirations framework, introduced in 2021, provides targeted incentives for high-tech, high-value investments that create skilled jobs and transfer advanced technology. Semiconductor packaging and testing perfectly align with these objectives.

Investment promotion agencies like MIDA have been particularly effective in attracting and facilitating semiconductor projects. Their one-stop service centers streamline approval processes and coordinate between different government agencies, significantly reducing bureaucratic hurdles for expanding companies. This efficient support system has become a key competitive advantage for Malaysia.

The country's education system has also adapted to support industry growth. Technical universities and vocational colleges have developed specialized semiconductor packaging curricula in collaboration with industry partners. Companies like Intel and Infineon run extensive apprenticeship programs that groom local talent for technical roles, creating a sustainable pipeline of skilled workers.

The economic impact of this semiconductor boom extends far beyond the factories themselves. Each direct job in the semiconductor industry typically creates 4-5 additional jobs in supporting sectors including logistics, maintenance, catering, and housing. The current expansion wave is expected to generate tens of thousands of these indirect employment opportunities.

Local equipment suppliers and service providers are experiencing unprecedented demand. Malaysian companies that provide specialty gases, chemical solutions, precision tooling, and facility maintenance are scaling their operations to meet the needs of expanding semiconductor facilities. This is creating a virtuous cycle of industrial development that strengthens Malaysia's overall manufacturing ecosystem.

Real estate markets in semiconductor hubs like Penang, Kulim, and Melaka are booming as expatriate technicians and local workers seek housing near the expanding facilities. Commercial property developers are rushing to build industrial parks, research centers, and residential complexes to accommodate the growing workforce.

Despite the optimistic outlook, the Malaysian semiconductor expansion faces significant challenges. The global competition for semiconductor talent is intensifying, with countries like the United States, Taiwan, and South Korea also expanding their chip manufacturing capabilities. Retaining experienced engineers and technicians has become increasingly difficult as multinational companies offer competitive international compensation packages.

Infrastructure constraints represent another concern. While Malaysia has relatively good transportation and utility infrastructure compared to many developing nations, the concentrated expansion in specific regions is testing the limits of local power grids, water systems, and road networks. The government is accelerating infrastructure projects to prevent these limitations from hindering growth.

Environmental considerations are also coming to the forefront. Semiconductor manufacturing is energy and water intensive, creating sustainability challenges. Companies are addressing these concerns through investments in renewable energy, water recycling systems, and carbon reduction initiatives, but balancing rapid expansion with environmental responsibility remains an ongoing effort.

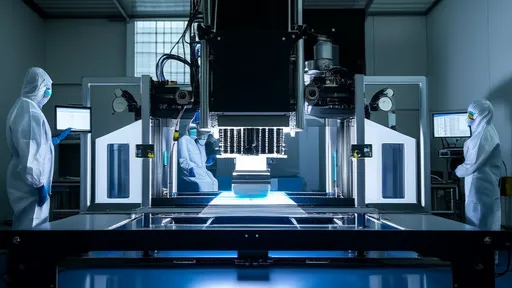

The technological transformation within Malaysia's semiconductor sector is as significant as the physical expansion. Companies are not merely building more of the same facilities—they're implementing the industry's most advanced packaging technologies. Fan-out wafer-level packaging, system-in-package solutions, and 3D chip stacking are becoming standard capabilities in Malaysian facilities.

Automation and Industry 4.0 technologies are being deployed at unprecedented scale. New facilities feature extensive robotics, artificial intelligence for process optimization, and sophisticated data analytics systems that monitor production quality in real-time. This technological upgrade is transforming the nature of semiconductor jobs, requiring more programming and data analysis skills alongside traditional technical expertise.

Research and development activities are expanding alongside manufacturing. Several companies are establishing advanced R&D centers in Malaysia focused on developing next-generation packaging technologies. This represents a significant evolution from Malaysia's historical role as primarily a manufacturing location toward becoming an innovation hub.

Looking forward, Malaysia's position in the global semiconductor landscape appears increasingly strategic. The current expansion projects will take two to three years to reach full production capacity, meaning the full impact of this investment wave will unfold gradually through the mid-2020s. Industry analysts project that Malaysia could capture an additional 3-5% of global semiconductor packaging and testing market share during this period.

The Malaysian government is already planning for the next phase of development. Officials have indicated that attracting semiconductor wafer fabrication—the frontend manufacturing process currently dominated by Taiwan, South Korea, and the United States—represents the logical next step in the country's semiconductor evolution. While this would require significantly larger investments and even more specialized infrastructure, the success of the current packaging and testing expansion makes this ambition increasingly plausible.

Global technology trends continue to favor Malaysia's specialization. The growth of artificial intelligence, 5G connectivity, electric vehicles, and Internet of Things devices all depend on advanced semiconductor packaging to deliver the performance and efficiency these applications require. As these technologies proliferate, demand for Malaysia's packaging expertise will likely continue to grow.

The Malaysian semiconductor packaging and testing boom represents a convergence of global supply chain realignment, technological evolution, and strategic national development. While challenges around talent, infrastructure, and sustainability require careful management, the country has positioned itself as an indispensable node in the global electronics ecosystem. As semiconductor companies continue their expansion, Malaysia's role in powering the digital transformation of the global economy appears set to grow even more significant in the coming years.

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025