In a development that promises to reshape the global lithium landscape, a Canadian mining giant has confirmed the discovery of what is being hailed as the world's second-largest lithium resource in the rugged wilderness of Quebec. The find, located in the James Bay region, is not merely significant for its sheer scale but for its timing, arriving as the world scrambles to secure the critical minerals necessary for the clean energy transition.

The company, which has maintained a strategic silence during its exploratory phase, released a comprehensive technical report that sent ripples through mining and energy sectors alike. Core samples and preliminary drilling data suggest a resource so vast that it could single-handedly alter supply chain dynamics for electric vehicle manufacturers and battery producers across North America and Europe. Geologists on the project describe the deposit as unusually high-grade, with mineralization that appears consistent across a substantial area, reducing the typical extraction complexities and costs associated with lower-grade ores.

The implications for Quebec's economy are profound. For decades, the province has been a powerhouse in hydroelectricity, and now it positions itself to become a cornerstone of the North American battery ecosystem. Provincial ministers have already begun framing the discovery as a catalyst for a new industrial era, one that combines green energy with green resource extraction. The term "lithium valley" is being whispered in government corridors, drawing parallels to historical resource booms that built nations.

Local communities, particularly the Cree First Nations, whose traditional territory encompasses the discovery site, are at the heart of the unfolding narrative. Unlike many resource projects that face immediate opposition, this one has been marked by a notably different tone. The mining corporation embarked on a consultation process years before the first drill bit touched the ground, establishing impact-benefit agreements that are being cited as a potential new standard for indigenous partnership in Canada's resource sector. These agreements reportedly include provisions for revenue sharing, employment guarantees, and environmental stewardship committees controlled by the community.

From a geopolitical standpoint, the discovery is a strategic windfall for Western nations. The global lithium supply chain is currently dominated by operations in Australia, Chile, and critically, China, which processes the majority of the world's lithium raw materials. A source of this magnitude within a stable, allied jurisdiction like Canada provides a tangible pathway for North America and Europe to build more resilient, ethically sourced, and geopolitically secure battery supply chains. Analysts suggest this could reduce reliance on foreign-controlled processing and mitigate one of the largest single points of vulnerability in the Western push toward electrification.

The market reaction was immediate and seismic. Shares of the discovering company soared, dragging the entire junior mining sector upward with it. More significantly, major automakers with ambitious EV production targets, who have been quietly negotiating offtake agreements for months, are now moving from tentative interest to firm commitment. The boardrooms of Detroit, Wolfsburg, and Tokyo are recalculating their long-term sourcing strategies, with Quebec suddenly featuring as a central pillar. The discovery has also ignited a fresh wave of investment in mining technology startups focused on more sustainable extraction methods, as the industry anticipates heightened scrutiny on the environmental footprint of its new prize.

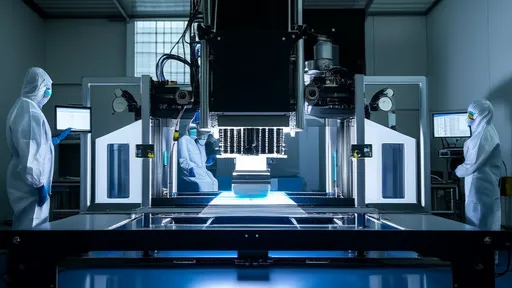

However, the path from discovery to production is fraught with both engineering and environmental challenges. The Quebec site, while rich, is located in a sensitive boreal ecosystem. The company's proposed method, a hybrid of traditional open-pit mining and innovative direct lithium extraction (DLE) technology, is being pitched as a lower-impact solution. This technology, which involves pumping brine to the surface, extracting the lithium, and then reinjecting the water, promises a smaller surface footprint and reduced water consumption. Yet, environmental groups are adopting a stance of "cautious vigilance," acknowledging the project's importance while vowing to hold the company to the highest standards of accountability.

The ripple effects extend beyond batteries and cars. Energy grid operators are watching closely, as large-scale, cost-effective battery storage is the key to managing the intermittent nature of solar and wind power. A stable, large-volume supply of lithium could accelerate the deployment of grid-scale storage projects, making renewable energy sources more reliable and ultimately cheaper. This positions the Quebec lithium find not just as a commodity story, but as a potential accelerant for the entire renewable energy sector.

As the project moves into the feasibility and permitting phase, all eyes will be on the timelines. The company has projected an aggressive schedule, aiming for production to begin before the end of the decade. If successful, the first lithium from what could be the hemisphere's most important new mine will hit the market just as global demand is forecast to outstrip supply. This discovery in Quebec is more than a lucky strike; it is a geopolitical event, an economic opportunity, and a test case for how the world will source the materials to power its future.

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025

By /Nov 5, 2025